What is wealthmaker.in ?

Wealth Maker gives efficient platform to manage all the core business operations

of our group. This is a flexible and scalable platform which gives easy connection

between different channels, products, clients, partners and employees. It is a runtime

tool and captures minute to minute details. It includes the following:

- Transactional Engine

- Reporting and tracking of business performance

- Portfolio

- Financial Planning tools

Client Report

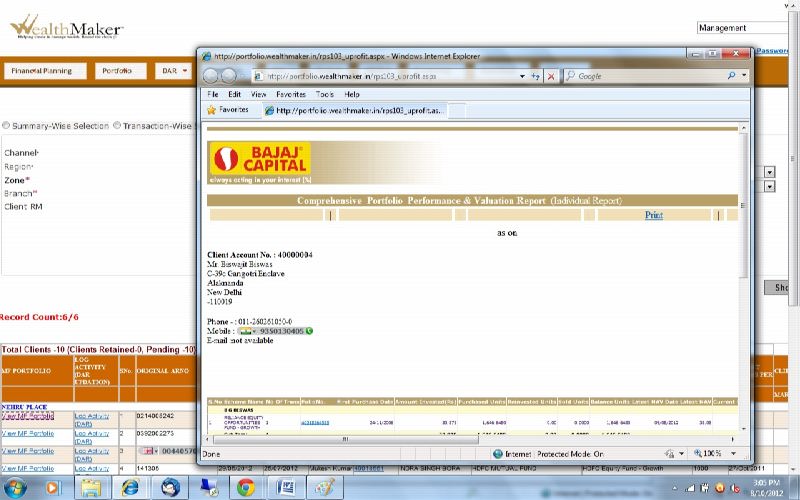

In this selection we would be discussing about how to fetch ‘Client Portfolio’ from

WealthMaker.in. Client report is a very important report for client. It is detailed

information of not only client’s mutual fund investment but also include the details

about the Investors who are under the client. Member Client’s information like what kind

of product is being purchased, on what date it’s been purchased, what is the folio

number, amount invested in the scheme, reinvested units, sold units, balanced units,

realized profit etc. are been mentioned with their appropriate details. The sales

people working are responsible to do the needful. Client report also helps him to

plan out his investment because it gives an overview of his mutual portfolio.

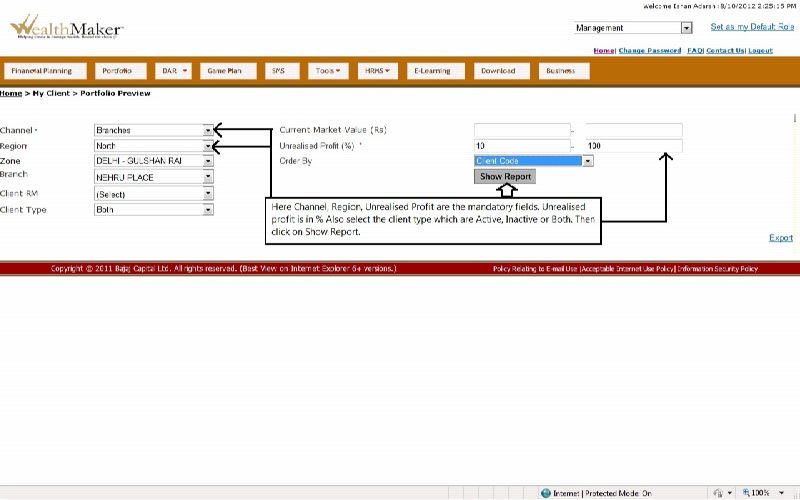

Portfolio Review

This is a way to fetch all the product information related to client. Using this

tab we can see our active, inactive as well as both clients. This tab is very useful

when we need to pitch a new product to a client. We can pitch a same category product

as well as we can cross sell as well. Making inactive client active tends to increase

our business and helps in increasing our profit scale also. The portfolio review

form has many criteria such as channel, region, zone, branch, RM in which some of

the marked fields are mandatory. Mandatory fields are required to fetch a portfolio

review of the client. Steps involved in Portfolio Review fetching:

- Open http://www.wealthmaker.in on your web browser (Internet Explorer is recommended).

- Enter your login Credentials, which will log in to wealthmaker.in.

- Now select the portfolio tab from menu bar.

Home-> Portfolio-> Portfolio Report-> Portfolio Review

- A portfolio review form will be opened, fill in all the mandatory fields, & select

the client type active, inactive or both.

Fill details-> Show Report

- Finally click on show report button to see the clients report.

- Now from the report you can click on to selected clients and see their full product

purchased information

Top

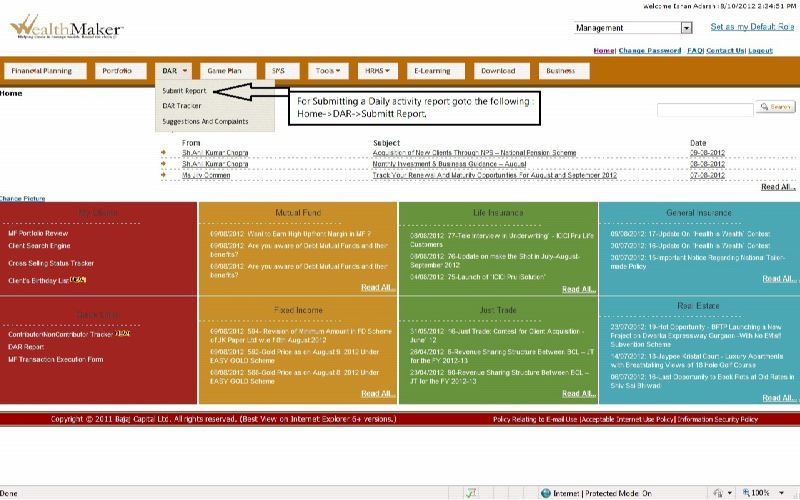

What is Daily Activity Report?

Daily activity report is to be filled by the sales persons. This Comprises of daily

activity report regarding new clients, or prospect clients. This helps the sales

person to keep track on their upcoming meetings as well as current day schedule.

Daily activity report is just like a daily diary in which all the day today meetings

are been entered by the sales person. This helps in submitting data of daily activity.

The user has to enter the name, purpose of meeting, product pitched, scheduled meeting

and many such things which are essential which are mentioned in the form. If the

client is an existing client we just have to search him/her and can directly enter

the details or else if the client is new we can use the log prospect client tab

to enter the details of the new client. DAR also helps in keeping track record of

an employee.

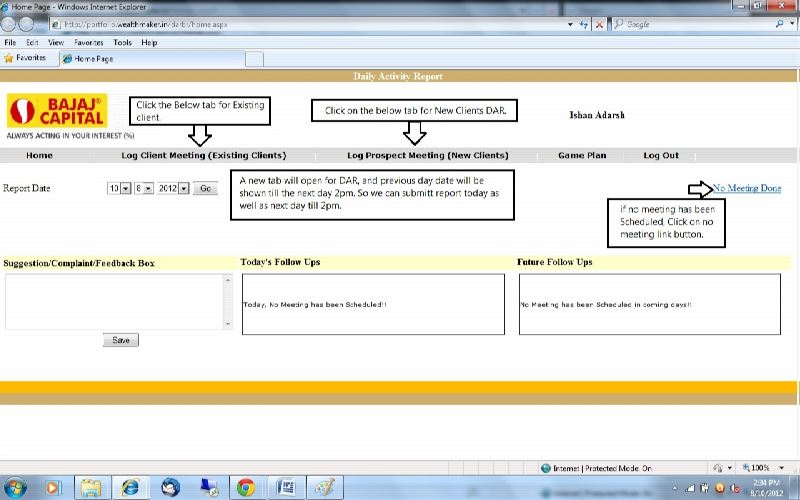

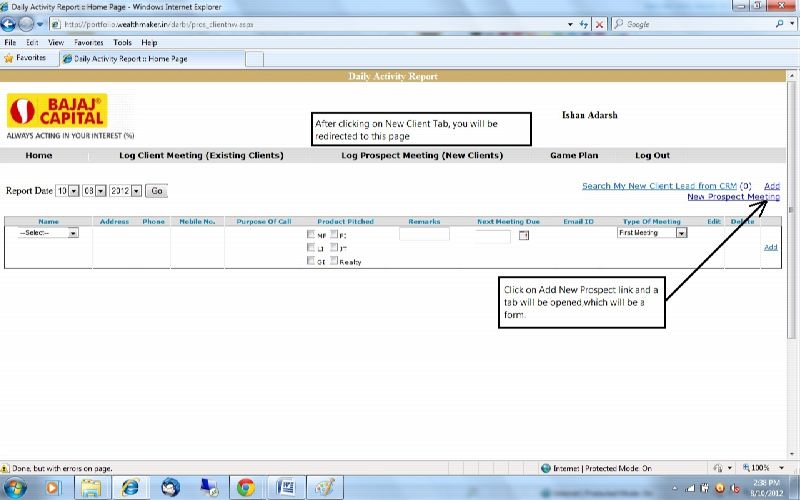

DAR (New clients)

This tab lies under DAR tab. Log prospect meeting is for the new client. If a sales

person meets a new client he has to fill form and mention all this information in

to the DAR. Information that he/she has to filled in DAR report are name, address,

mobile number, phone number, purpose of the meeting, product pitched, meeting date,

next due date, type of meeting, lead source, email id & remarks.

Steps involved in Filling Log Prospect Meetings (New Clients)

Following are the steps of filling a DAR for a new prospect client.

- Open http://www.wealthmaker.in on your web browser (Internet Explorer is recommended).

- Enter your login Credentials, which will open wealthmaker.in

- Now click on DAR tab and then click submit report (a new tab will be opened).

Home-> DAR->Submit Report

- In the new tab click on log prospect meeting (New Clients), you will be redirected

to a new form page.

- On this page click on Add new prospect Meeting, a pop up will be opened, fill all

the required mandatory fields and click on submit button.

- Click on Add new prospect for new client.

- Fill mandatory fields and click on submit

- Your new client DAR is now filled and submitted.

Top

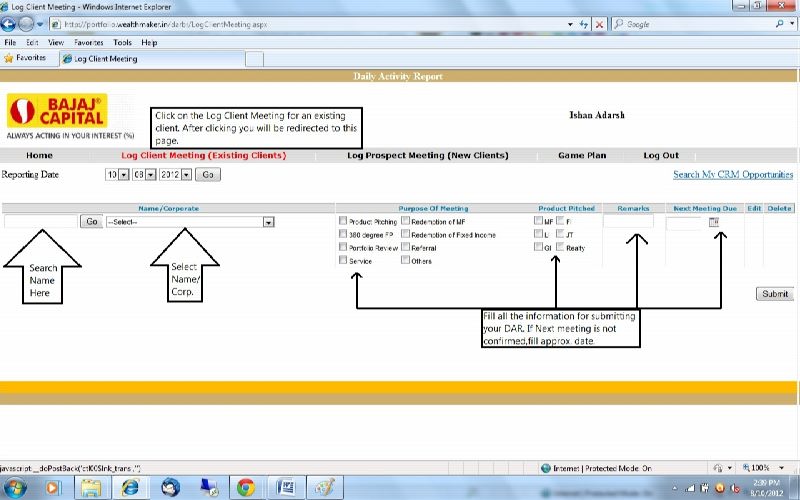

DAR (Existing Clients)

Log client meeting (Existing Clients) tab is found on the second tab of the DAR

home page. This report has to be filled for the existing clients. You have to search

for the client and then fill in all the desired information in the form. The information

that has to be filled by the user are name, purpose of meeting, product pitched,

scheduled meeting and many such things which are mentioned in the form. After filling

the information click on submit button and the DAR for the employee will be recorded

in the database.

Steps involved in Filling log client meetings (Existing Clients)

- Open http://www.wealthmaker.in on your web browser (Internet Explorer is recommended).

- Enter your login Credentials, which will open wealthmaker.in

- Now click DAR tab and then click submit report (a new tab will be opened).

Home-> DAR-> Submit Report

- In the new tab click on log client meeting (existing Clients), you will be redirected

to a new form page.

- Search for the client by entering the name and clicking on go.

- Select the exact client by selecting the name/organization.

- Fill in all the desired fields such as product pitched, purpose of meeting, etc

fields and click on submit.

- Your DAR for an existing client has been recorded in the database.

Top

DAR Tracker

DAR Tracker is used to keep a track record of the DAR submitted by the various sales

person. The DAR submitted by employees can be seen by them as well as their seniors

too. For fetching your own report or reports of people working under you, we can

use DAR tracker. This report helps in keeping track of employees. There daily activities

are been seen from this report. If somehow the employees could not fill the daily

activity report his/senior can trace it out and can cross question on it. So basically

for tracking a DAR we use DAR tracker.

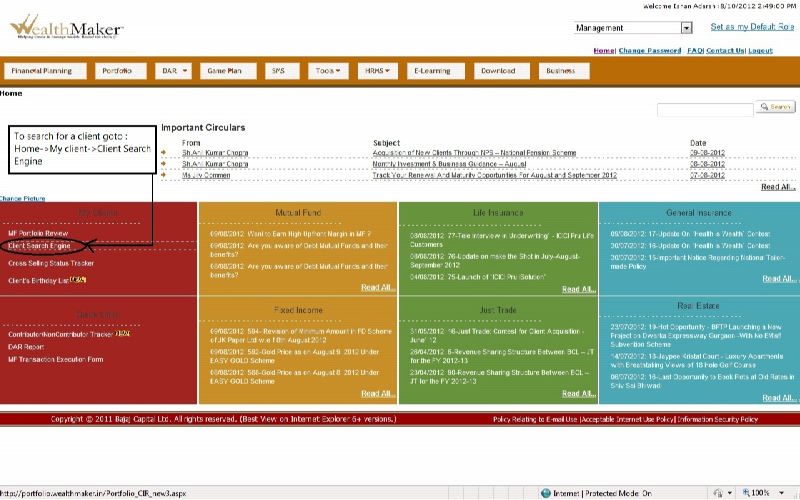

What is Client Search Engine

Client Search engine is used to search a client. Select all mandatory parameters

i.e. Channel, Region, Zone and Branch. Also, you can choose the Client Type as Active,

Inactive or Both. You can choose the sorting criteria by selecting the required

“Order By” Value. On Client Search Engine Page, you will find the following two

options:

- Summary wise selection

- Transaction wise selection

- Renewal/maturity opportunity

- Cross sell

- Client investment report

In summary wise there are various criteria such as total business volume, total

number of transaction, & total margin.

Significance of Client Search Engine

- How to keep a track of your Client?

- We can perform Client data analysis with different Permutation & Combination.

- It is very good for cross selling opportunities.

- You can see the overall portfolio of a client AUA asset under advice, which helps

in providing better service to the client.

- Using this tool we can make a track record of Renewable / Pending dues.

- Using this tool we can track many things using a single platform.

Top

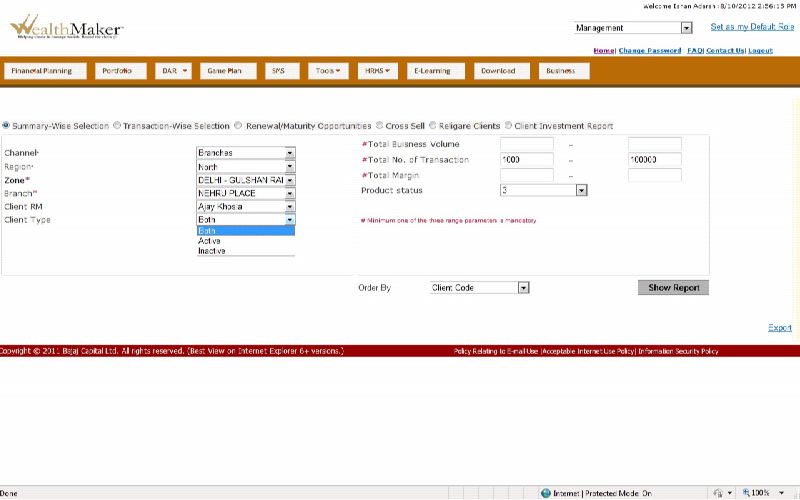

Summary Wise Selection

- Fill in any one of the range criteria parameters i.e. Total Business Volume,Total

Number of Transactions, Total margin.

- Select the value of Product Penetration from the drop down menu.

- Click on Show Report button

Top

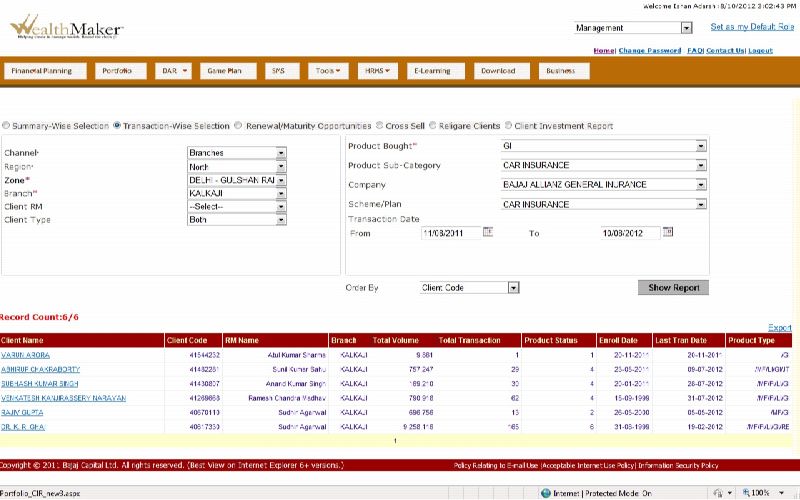

Transaction Wise Selection

- Select all mandatory parameters i.e. Channel, Region, Zone and Branch.

- Choose the product type from “Total business volume” ,”Total number of transaction”

,”total margin” (mandatory criteria) drop down menu.

- You can choose other parameters as well like: Product sub category, Company, Scheme/Plan

etc.

- Select From and To date from Transaction Date calendar option. Click on Show Report

button.

Top

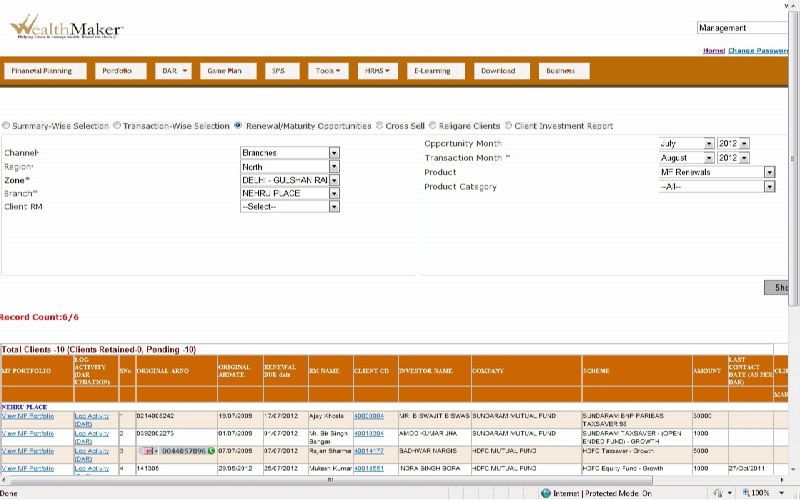

Renewal/Maturity Opportunity

- Select all the mandatory parameters such as region, zone, etc.

- Transaction Month is the mandatory field.

- Click on show button.

Top

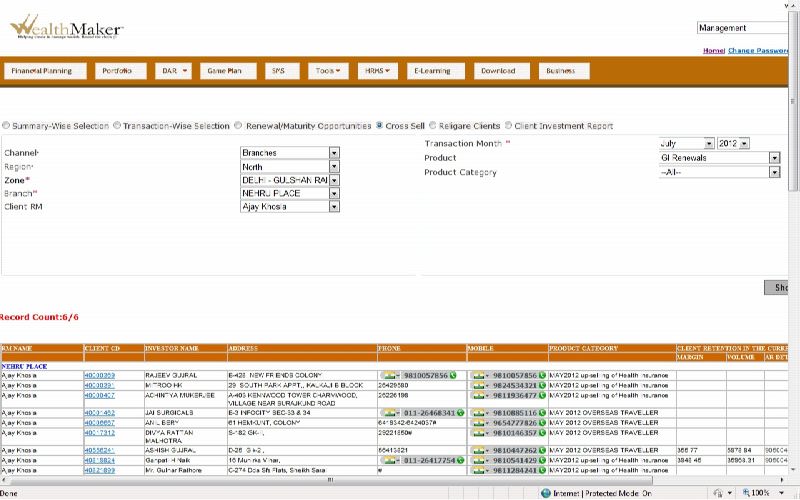

Cross sell

- Select all the mandatory parameters.

- Transactional month is the mandatory field.

- Click on show report.

Top

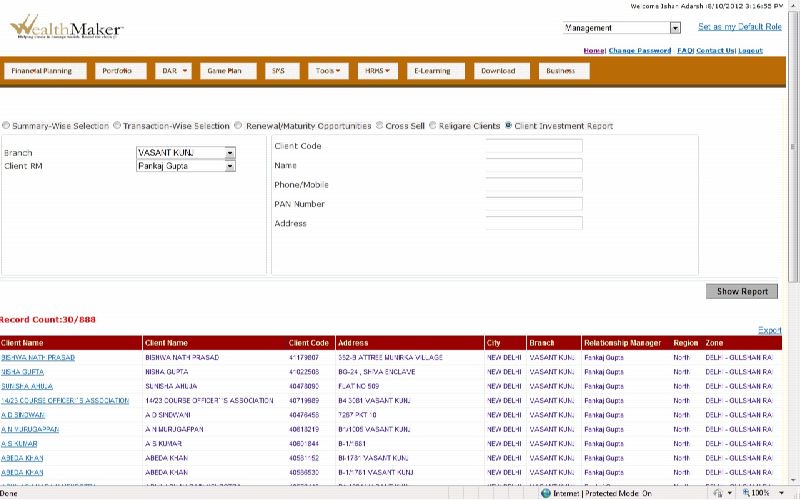

Client Investment Report

- Fill branch, Client RM, and other fields for searching the client.

- Now click on the exact client name.

Top

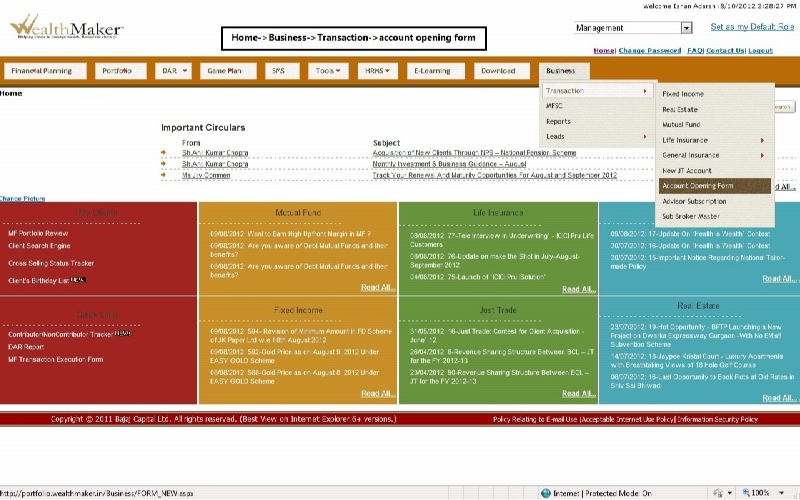

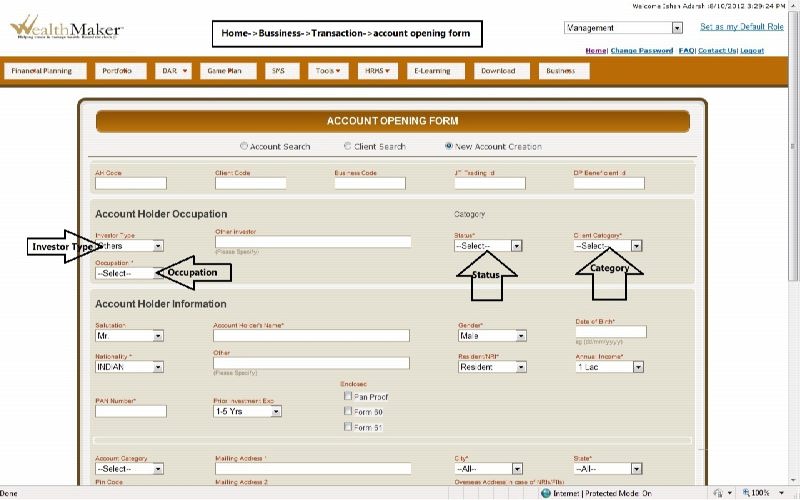

Account Opening Form

Account Opening Form is used to open a new customer’s account. Without an account

a customer cannot proceed with his transactions. Account opening form consists of

detailed information about the client. Member Client type, occupation, status, category

are some of the criteria of filling the form. Account holder’s information such

as his/her identity proof type has to be mentioned in the form. All criteria have

to be fulfilled before submission of the account opening form.

Home-> Business-> Transactions-> Account Opening Form

ACCOUNT OPENING FORM

- Fill account holder’s occupational information such as investor type, other investor,

status, client category & occupation.

- Now second category is account holder’s information. In this you have to fill salutation,

account holder’s name, gender, date of birth, nationality, annual income, PAN number

etc.

Top

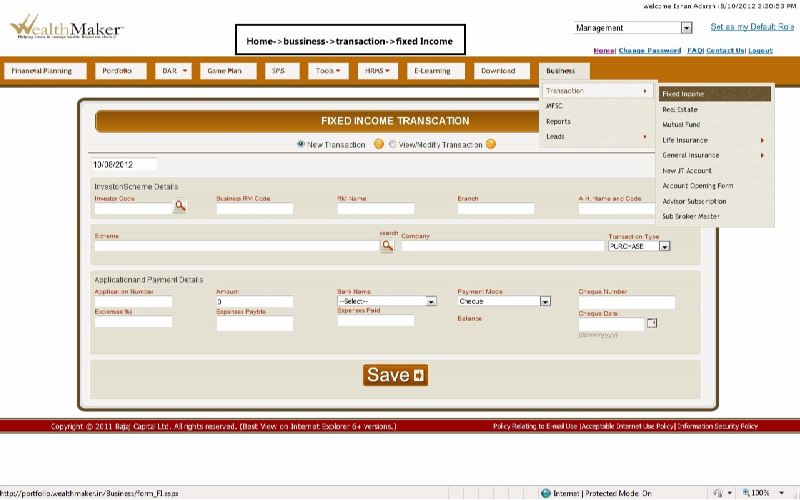

Fixed Income Form

Steps of filling Fixed Income Form:

- Search for the Member Clients code, if Member Client code is not found fill the account opening

form, if Member Client is found select the Member Client by clicking it.

- Now search for the scheme\plan name, & select the exact scheme\plan.

- Enter the application and payment details.

- Enter the transactional details.

- Now finally save the form by clicking on save button.

- An “acknowledgement Receipt” or “Transaction Receipt” number will be generated;

this will be used for further enquiry regarding the transaction.

Home -> Business -> Transaction -> Fixed income

Top

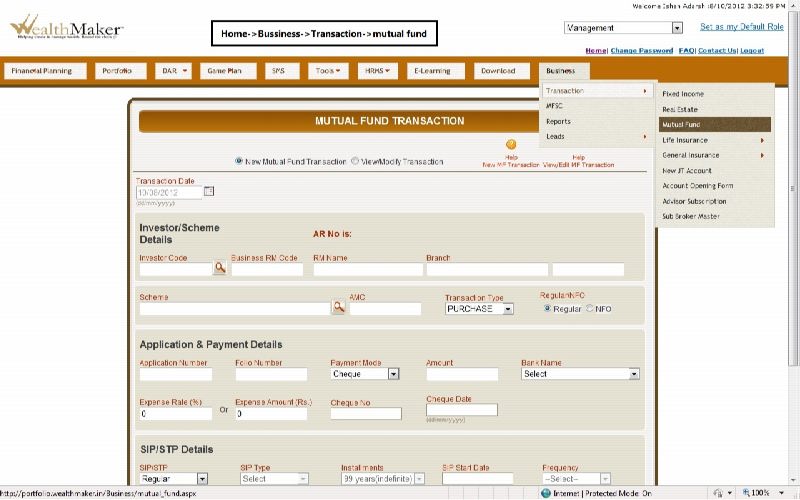

Steps of filling Mutual fund form:

- Search for the investor code, after investor is found select the investor by clicking

it.

- Now search for the scheme\plan name, and select the exact scheme\plan.

- Enter the application and payment details.

- Enter the transactional details.

- Enter the SIP/STP Details.

- >Now finally save the form by clicking on save button.

- An “acknowledgement Receipt” or “Transaction Receipt” number will be generated;

this will be used for further enquiry regarding the transaction.

Home -> Business -> Transaction -> Mutual Fund

Top

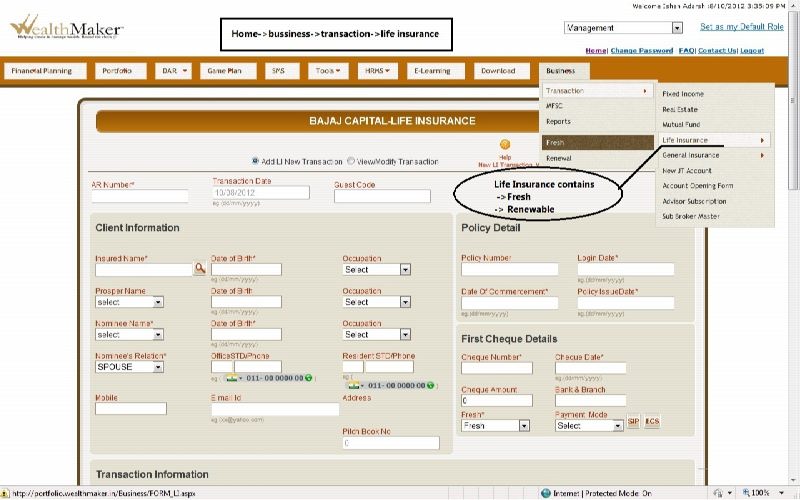

Life Insurance Fresh form

Life insurance form contains two criteria:

- Fresh life insurance form.

- Renewable life insurance form.

Home-> Business -> Transaction -> life insurance->fresh

Top

Home-> Business -> Transaction -> life insurance->Renewal

Top

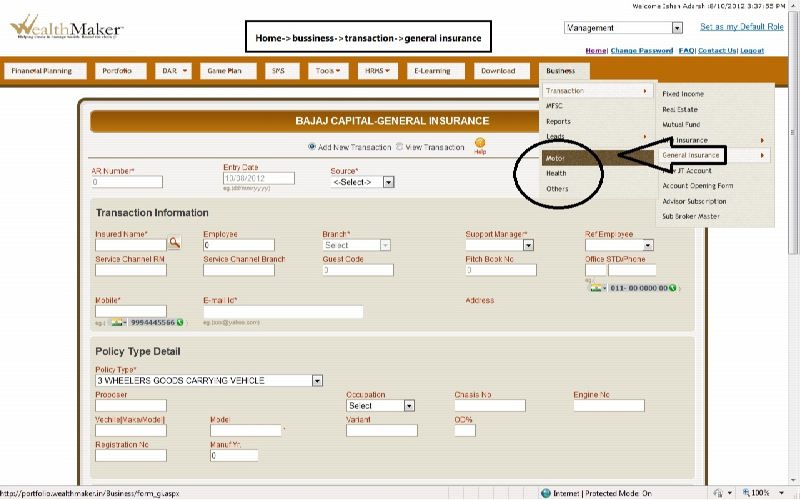

General Insurance Form

General Insurance Form contains three criteria:

- Motor insurance.

- Health insurance.

- Other’s.

Home ->Business -> Transaction -> General Insurance

Top

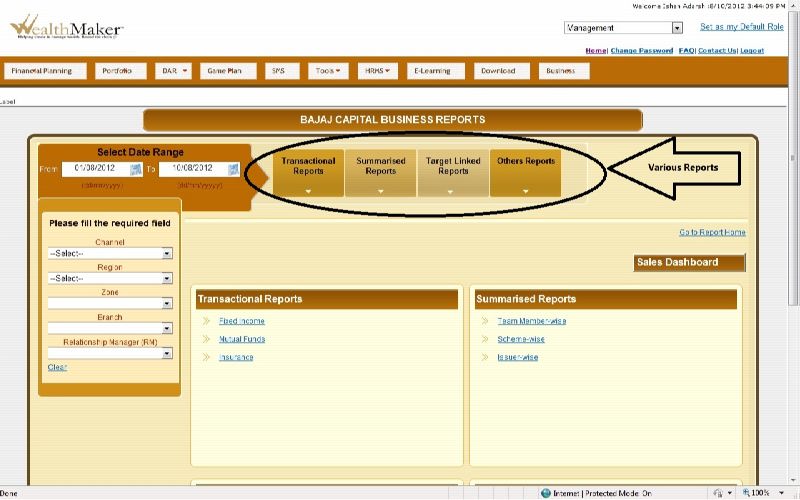

What are the various types of reports?

- Transactional Reports

- Fixed Income.

- Mutual Funds.

- Insurance.

- MFSC Reports.

- MF SIP Reports.

- MF SIP Registration Reports.

- Mutual fund trail Reports.

- Summarized Reports

- Team member wise.

- Scheme wise.

- Day wise Margin.

- Target Linked Reports

- Margin Target Achievement Report.

- 6/6 Product target achievement Report.

- 6/6 performance tracking report.

- ANA Billing

- ANA Bill Summary.

- Other Reports

- Revenue loss Report.

- Cancellation Report.

- ECS Report.

- Account Status Report (MIS 57).

- Call Center Report.

Top

Report Fetching

Reports are the summarized reports of the data collected in the database. Reports

are very useful for calculating the margin earned and helps in calculating future

investments.

Home -> Business -> Reports

REPORT PAGE

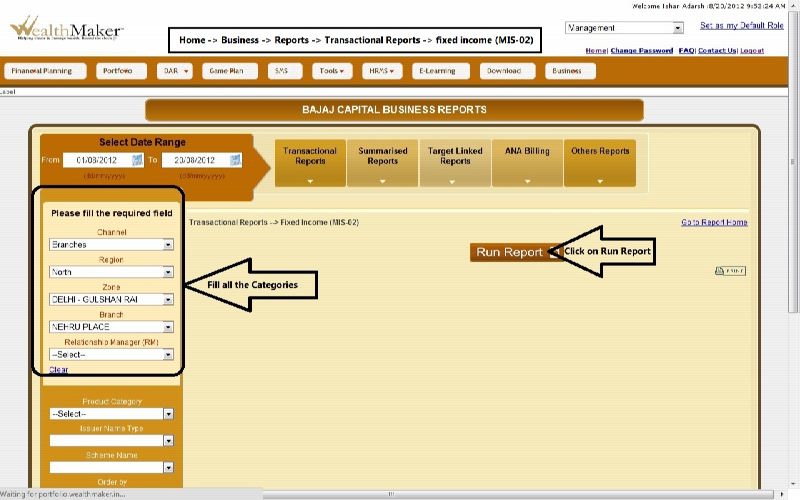

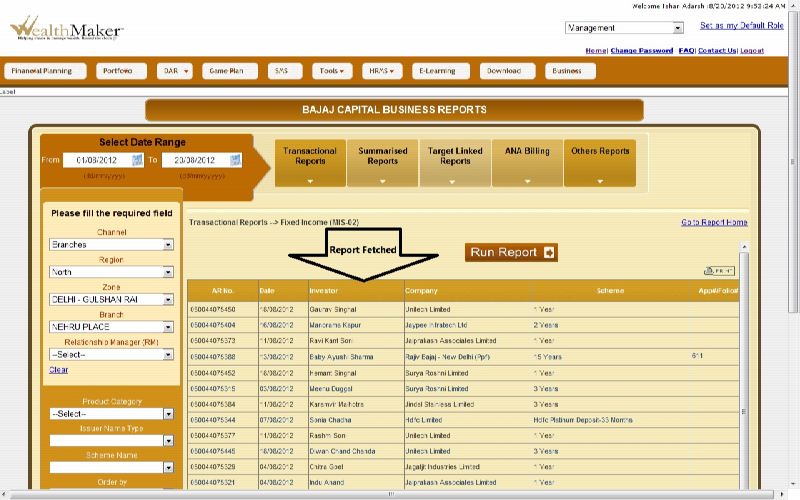

Steps of fetching the Fixed Income report:

- Click on report sub menu under Business tab on the menu bar.

- You will be redirected to reports page where various tabs for menu and their sub

menus are been displayed.

- Then Go to ->

Home->Business->Reports->Transactional Report->Fixed Income Report

- Click on Fixed income tab under transactional report.

- Select Channel, Region, Zone, Branch, Relationship Manager (RM).

- Click on Run Report.

- Now the report can be printed by clicking on print or can be stored to the system

by clicking the same.

Above is the report fetched from wealthmaker.in

Top

Team Member wise

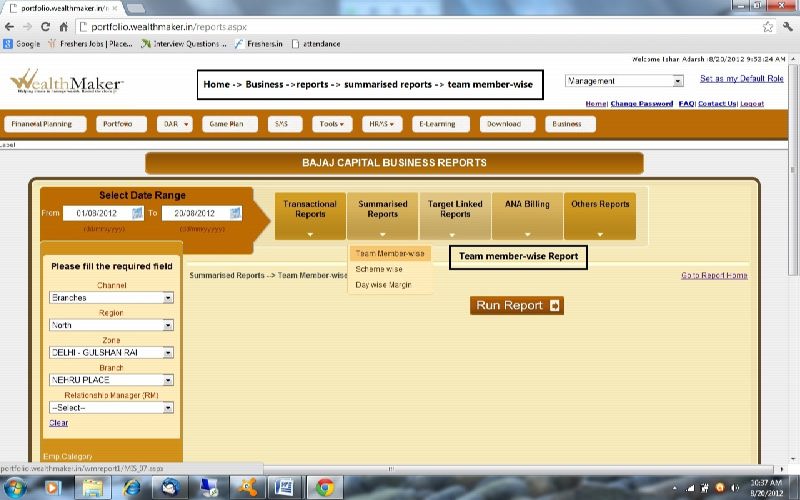

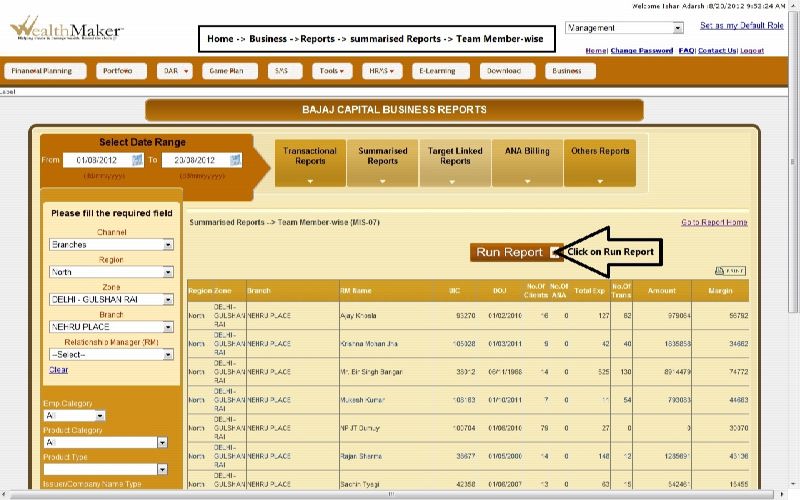

- Click on Team Member wise tab under summarized report menu.

- Select Channel, Region, Zone, Branch, Relationship Manager (RM).

- Click on Run Report.

- Now the report can be printed by clicking on print or can be stored to the system

by clicking the same

Home -> Business -> reports -> Summarized Reports -> Team Member wise

Above is the result of Team member wise report.

Top